Forever home loan savings without the forever admin

Open’s Auto Negotiator lets you automate better deals and notifications so you never miss out on your best rate with big savings. Combining tech and expert mortgage brokers to serve you best.

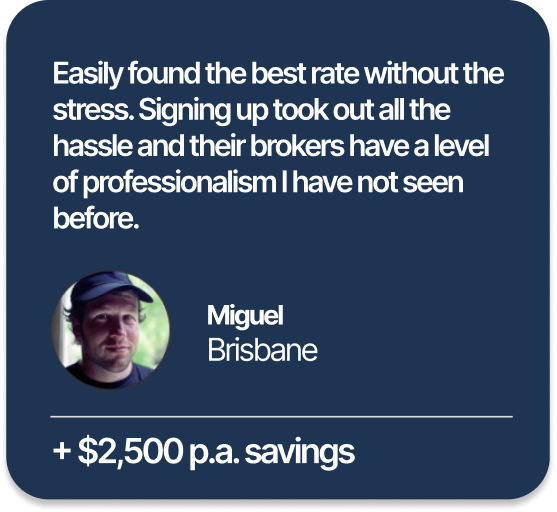

Join Alicia, Timothy, and 9,587 others.

Peace of mind you’re always on your best loan

No more hassle

Tired of endless manual Google searches and comparison fatigue? Our tech scans the market regularly to ensure you're always on the best rate. The best part? It's free, forever.

Never overpay again

Tell us your desired savings amount and relax. Open’s tech finds the perfect match and alert you when it hits, with mortgage broker support. No pressure, just peace of mind.

Stay in control

If you’re on the deal that’s best for you, it’ll reassure you. Got big savings? Decide whether you want to stay put, let us negotiate with your bank, or apply to refinance in just minutes - the power is yours.

Open is Australia’s first and only mortgage technology platform that automates better home loan deals. We do all the hard work so you don’t have to.

- ASIC and ACCC regulated

- Highest Standard of security

- Unsubscribe anytime

Our mission is to make banking fair, fast, and simple for all.

Open has been approved by the ACCC due to our most secure enviroment. Your information is securely saved through big secure providers Microsoft and Amazon AWS. This information is safely kept and can be deleted at any time as requested by you. Our providers regularly conduct audits to ensure their systems are the most secure.

Most of your information in the application process (example income, debts, expenses) is gathered from something called ‘Open Banking’. This was created by the Treasury and Australian Competition & Consumer Commission (ACCC).

Open Banking was made to give you the steering wheel for your banking data. It’s all about you – you get to pick who sees your data, it makes swapping banks a breeze, and it gets banks hustling to offer you the best deals.

Think of it like a data-sharing system. It’s a way for your bank to securely share your financial info with approved providers (like us), but only if you say it’s okay.

We only access your information for the day (no ongoing monitoring), grab the information we need (e.g. income, debts), cannot make any changes on your accounts or access any passwords.

We don’t charge you any fees for using our services. We make our money from commissions paid by the banks when we suggest a loan and you choose to refinance it with our expert broker help.

We get two types of commissions: an ‘upfront’ one that’s a one-time payment when your loan settles, typically a small percentage of your loan amount, and a ‘trail’ commission that’s a small yearly fee we receive for as long as your loan is active. Our service will always involve active loan management, which means we’re always automatically on the lookout for better deals without any hassle to you.

All rights reserved. Important Information. Open acknowledges the Traditional Owners of the lands across Australia as the continuing custodians of Country. We pay our respects to First Nations peoples and their Elders, past and present.